Solutions to Urban problems are often proposed by urban planning professionals based on whatever urban planning theories hold sway at the time. Often these proposed solutions are generated “top down” by “experts” using an internationalist template of “best practice” with a cursory reference to the communities living within neighbourhoods. Is there a better, more effective way?

Solutions to Urban problems are often proposed by urban planning professionals based on whatever urban planning theories hold sway at the time. Often these proposed solutions are generated “top down” by “experts” using an internationalist template of “best practice” with a cursory reference to the communities living within neighbourhoods. Is there a better, more effective way?

Today it is taken as given by many authorities that in most western liberal societies and certainly within a UK context, modern urban planning should promote diversity, inclusion, complexity and creativity (Baycan-Levent, 2010) (Jacobs, 1961) (Sasaki, 2010) (Florida, 2003). This is demonstrated by the focus on the social rather than purely functional and economic uses of place by the feminist planners of Cole.Lectiu Punt 6 in Barcelona (Escalante & Ladivia, 2015) (Cole.Lectiu Punt 6, 2019). Urban theory has in parts shown a progression from urban planning framed to develop a distinctly middle-class restorative utopia and blueprint for an ideal society as demonstrated by Ebeneezar Howard’s 1903 treatise “Garden Cities of To-Morrow” (Tizot, 2018) which postulated an alternative to the overcrowded and polluted industrial cities of the turn of the twentieth century with his solution centred on creating smaller “garden cities” through the now often disparaged view of cities as “machines to live in” (Le Corbusier, 1946) and Le Corbusier’s “City of Three Million” model (Corbusier, 1929) and subsequent paradigmatic design for “Ville Radieuse” with its geometrically planned for “towers in a park,” produced with no reference to existing neighbourhoods which for more than a generation would influence planners. Reginald Isaacs however rejected earlier definitions of neighbourhood as given by Dahir (1947) pointing out that in modern times people are mobile and therefore can chose to work, spend their money and engage in leisure activities, anywhere in the city and further afield, emphasising that this wide choice and opportunity is the raison d’être for cities (Adams, et al., 1949)

The perceived riposte to the those propounding these physical structure centred theories were influentially voiced by Jane Jacobs, Louis Wirth and others who focussed on the “intricate network of social interrelation” (Wirth, 1938) (Kasarda & Janowitz, 1974) (Jacobs, 1961). Others including “Situationist” artists and architects who in the 1950’s aimed to portray the city as it was experienced by its real residents, not necessarily as it was ‘top down’ planned by urban planners and architects (Badger, 2012)

The theoretical concepts behind these different approaches to place development and planning in of themselves posit that solutions to urban problems often require external intervention (Tizot, 2018) (Le Corbusier, 1946) (Dahir, 1947). Although Jacobs seems to indicate that solutions to urban problems can arise from within the community itself – for example she comments that crime can be prevented by “kibitzers”, shopkeepers and the community as a whole through having eyes on the street and a personal investment in the prevention and reporting of that crime (Jacobs, 1961). Commentators such as Richard Florida have focused on how creativity can have a paradoxical nature, both subverting and being used for production of the neo-liberal city (Florida, 2003) some examples of this in modern times include the direct actions through the “protestival” (protest+carnival) (Carmo, 2012) and there is much evidence on the effects communities can have on place and image or perception of place (Florida, 2003). It could argued that the natural conclusion of the community centred interventions postulated by Jacobs (1961) and latterly by Florida (2003) is the Gentrification of a neighbourhood. Some sources would say that this is also the expected and possibly welcome outcome of urban regeneration, but caveat the importance to consider and resist the neglect and marginalization of those people being” socially cleansed” or displaced by that gentrification (Lees, 2018) (Hamnett, 2003) .

One of the many examples of where urban theory has been applied to real world urban problems is in Gloucester UK. Since 2006 with the formation of the Gloucester Heritage Regeneration Company, much emphasis was placed by that organisation and Gloucester City Council on top-down physical regeneration of the city as a solution. At the historic Gloucester Docks, massive investment from Peel Holdings, the Regional Development Agency and others led to the regeneration of derelict docks transforming the area with a designer outlet and for the area relatively expensive apartments. This model has been looked on with envy by some stakeholders in other geographic areas of the city, including some of the principals of the businesses in lower Eastgate quarter and their representatives on the board of the Gloucester Business Improvement District and the perceived benefits that public realm improvements could make to an area in reducing crime, improving footfall, improving the ambiance, increasing property values, increasing business and residential occupancy and so-on. In common with several commentators the process of ‘gentrification’ which was first coined by the British urbanist Ruth Glass in 1964 is perceived by those promoting it as being largely beneficial (Lees, 2018) (Steinmetz-Wood, et al., 2017) (Hamnett, 2003)

Examining in detail the Lower Eastgate area in Gloucester (United Kingdom) that has been identified as needing intervention by businesses in the area and by residents provides an interesting model to critically evaluate the relevance of urban theory when applied in a real world situation and provides lessons for other urban areas. The Lower Eastgate area is an area of high deprivation in the Barton and Tredworth Ward of Gloucester, one of the poorest in the United Kingdom with a reported 43% of children in poverty (Gloucestershire Live, 2018) it has a high level of ethnic and cultural diversity with 41.4% of the population from non-white ethnic groups, and nearly one quarter identifying themselves as Muslim, one quarter as Sikh and nearly half identifying themselves as Christian (Brinkhoff, 2018). Lower Eastgate Street forms part of the historic core of Gloucester City, it has an eclectic mix of different uses and includes cultural and architectural heritage that combine to characterise the street including nightclubs, a theatre, take-away and sit in restaurants and independent businesses alongside residential. Gloucester City Council’s Public Realm Strategy categorises Lower Eastgate Street as a secondary street which surrounds the historic gate streets and lanes and forms the outer layer of public realm within the City Centre, having an important strategic and functional role. There have been hopes expressed by the Gloucester Business Improvement District (Gloucester BID) to create an “Urban Village” (Pollard, 2004) similar to the aspirations for Birmingham’s Jewellery Quarter, which in itself raises some questions about the ultimate benefits to current residents and local business owners which were highlighted by Jane Jacobs and others and as a critical failing leaves unanswered how broader urban regeneration strategies, will affect existing material and social networks, and the potential for “undemocratic, exclusionary geographies being produced through such regeneration schemes” (Pollard, 2004)

An important problem for Lower Eastgate and its environs are perceptions by residents and visitors that crime and anti-social behaviour are at high incidence within the neighbourhood, evidence of crimes reported indicates that initially these perceptions are in some part grounded in fact – during October 2019, 139 crimes were reported in the area with a much lower number of 36 crimes being reported in the the area that reported the second highest number of incidents, however the devil is in the detail as further investigation demonstrates that only 38 of the reported crimes actually took place on Lower Eastgate Street and immediate neighbourhood The remaining crimes related mostly to shoplifting offences that took place in the proximate city centre shopping area (Police UK, 2019) There is also a difference in the class of offences being reported with a higher proportion of antisocial behaviour and violence and sexual offences being reported in the Lower Eastgate immediate area. Conversations with Police officers indicate a direct correlation between this mix of incidents and the concentration of night time and late night economy businesses within Eastgate Street. As has been commented upon for city districts to be successful it is essential that residents and visitors must have the perception of assured personal safety and security (Jacobs, 1961) – people can choose to go where they like for goods and services (Isaacs, 1949) and are unlikely to go to areas which are perceived as un-safe or unattractive. Gloucester City Council and stakeholder groups including the the Gloucester licensed Victuallers Association, Gloucester BID, and The Evening Economy Group, have put much effort into changing perceptions of of the safety and security of the area including working to achieve the Association of Town and City management “Purple Flag” status (Gloucestershire Live, 2018) (ATCM, 2019)

The “Broken Windows” model posited by Wilson and Kelling (1982) proposes there can be a process where neighbourhoods decline into areas of high crime through a developmental sequence of disorderly conditions, wherein “social incivilities” – street drinking, antisocial behaviour, and “physical incivilities” for example abandoned buildings and disused plots, fly-tipping and trash on the streets and so-forth incites fear amongst local residents and visitors. With a growing fear of crime those families that have the means leave the area, and remaining residents develop behaviours where they separate and quarantine themselves from the community. This leads to a cycle where the lack of control and observation leads to an escalation as anonymity increases, attracting more potential offenders to an area, more antisocial behaviour and increases in serious criminal behaviour. Wilson and Kelling (1982) argued that serious crime developed because the police and citizens did not collaborate to prevent urban decay and social disorder, they used the metaphor that ”a broken window left unrepaired will soon lead to the breaking of all other windows in a building”. Philip Zimbardo’s field experiments with abandoned cars gave some authority to this view indicating that vandalism and more serious crimes can occur anywhere where the jell of civility and mutual regard had been eroded (Zimbardo, 1973). Wilson and Kelling (1982) further contended that serious crime would develop because the police and citizens did not work together to prevent urban decay and social disorder. Jane Jacobs had a slightly different view arguing that the “public peace” is kept and enforced by the community itself, based on a complex web of voluntary standards and often unwritten rules for behaviour and the police were a secondary influence. Her discussion of this effect in North End, Boston demonstrated that the resident “kibitzers” (by Jacob’s definition the engaged spectators in a community) and shopkeepers prevented a high number crimes through their intervention (Jacobs, 1961) this provides a sharp contrast to the examples described by Wilson and Kelling (1982) which were characterized by a lack of topophilia, increasing isolation and anonymity which lead to an increase in crime.

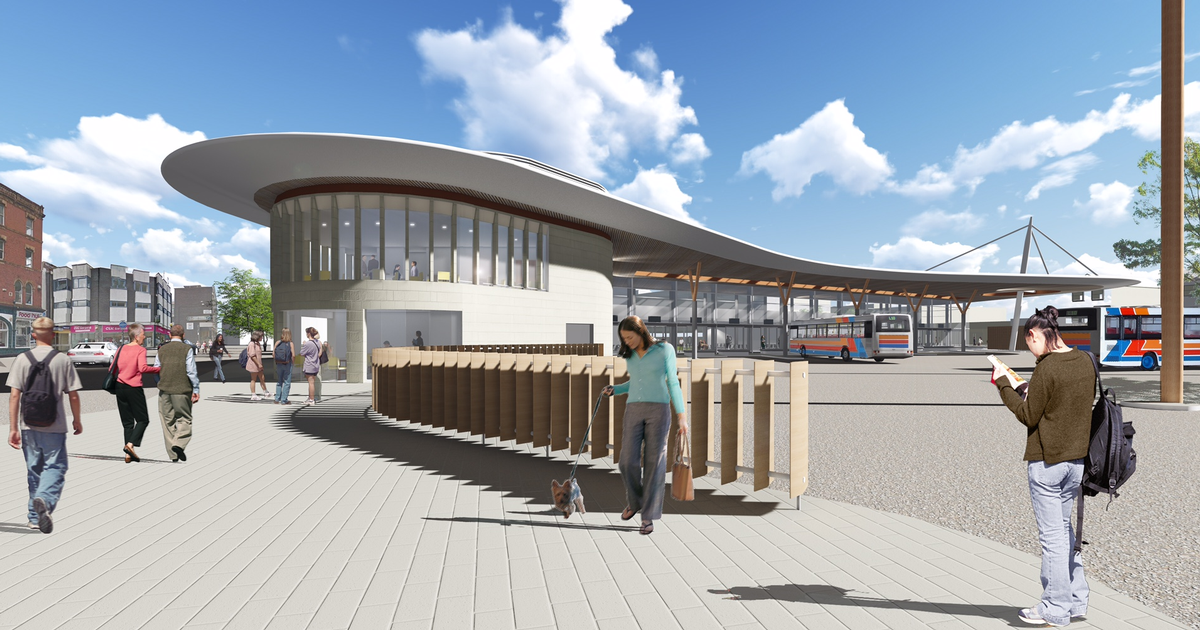

Replicating what is considered to be a successful model developed elsewhere in the city of Gloucester the proposed intervention for Lower Eastgate Street follows current urban theory and practice using a socio-spatial process (Moor, et al., 2006) (Gehl, 1971) (Wilson & Kelling, 1982) and by investing in transforming the public realm and the built environment to develop a pleasanter, more attractive neighbourhood and act as a spur for further regeneration. Funding for this would in part come from the Gloucester BID, Gloucester City Council and Highways Agency through Gloucestershire County Council. Key to this intervention should be following the clarion cry of Jan Gehl (1971) “Life, Spaces, Buildings – and in that order please” and the principles outlined by Jacobs (1961) and other commentators where the understanding and importance of human behaviour is classed as equally important as the understanding of urban elements including public realm, built environment and transport systems (Gehl & Svarre, 2013). In line with the theory previously outlined it is proposed that this intervention will help create an area perceived to be safer from crime, safer for pedestrians, create an environment that will build civic pride and encourage inward investment (Collins, 2016). The example of Kimbrose Triangle and other areas in Gloucester where similar interventions are credited with having the same effects has been seized upon by local business owners as proof that this will work in Lower Eastgate Street, other examples globally also support this (Furlan, et al., 2019 ) (Moor, et al., 2006)

Currently Lower Eastgate Street is dominated by its wide road, carrying two-way traffic and providing bays for a large number of buses and on street parking. There are a number of derelict buildings, and currently no trees or green spaces.

Specific proposed interventions aim to improve the character and quality of the street and encourage pride in place by creating a pedestrian focused and vibrant streetscape that relates primarily to current uses by residents and visitors and has the potential to drive footfall from the city centre and attract inward investment by strengthening pedestrian connections between Lower Eastgate Street and Eastgate Street as well as improving the connections to the primary streets and activity hotspots. It is proposed to reduce the carriageway to four metres, providing wider pedestrian footways to accommodate street trees, furniture and create social spaces and café culture which will promote healthy communities and to achieve high levels of safety and amenity through developing a vibrant community in an environment that is conducive to putting eyes on the street and help to conserve and enhance the historic environment and strengthen the night time economy along the street. Integrating existing parking and bus stops along the street would ensure that the street’s economy and activities are serviced, replicating the current short term parking, drop in/drop off nature of commercial and community activities in the street such as take-away restaurants, nursery, health centre, nail bars and so-on.

On balance notwithstanding some risks, highlighted later, the proposed intervention is one that has much to recommend itself. The main criticism about the approach outlined above is that the solutions proposed are based on an “expert generated” physical regeneration as a panacea for all urban problems facing areas such as Lower Eastgate Street. Experience has shown the dichotomy between the livability discourse promulgating a representation for some cities that is in stark contrast to the experience of residents (McArthur & Robin, 2019). While proposals for urban regeneration often talk grandly about the importance of community engagement as shown in the England (UK) regeneration scheme, the 1998–2010 New Deal for Communities programme (Lawless & Pearson, 2012) (Bailey, 2010), they are often light on proposing any social or community initiatives, or engagement by voluntary or public sector to shape the solutions to the issues facing the area such as crime, antisocial behaviour, drugs, prostitution and run down built environment – there often appears to be little effort to genuinely involve the community as a whole from an early stage. The literature recognises that wider stakeholder engagement gives better potential to achieve plan for redevelopment which could garner consensus and has the potential to mitigate resistance from communities often associated with ‘top down’ urban planning (Newton & Glackin, 2013) (Ball, 2004)

This lack of “ownership” by residents could lead to solutions that are inauthentic to the communities of the area and not fit for purpose for the needs of the community. The concept of bringing a pocket park has much to recommend itself in general urban theory and practice (Lee & Kim, 2015) however the same empirical evidence indicates that where there is no buy in to development of this type of space and where its establishment is not community led – and potentially “policed” under the “kibitzer” model highlighted by Jacobs (1961) there is a danger of the public space not being adopted by the majority of residents instead becoming a haunt of anti-social behaviour. A similar pocket park initiative to that proposed was developed in Gloucester’s Conduit street as a “bright idea” from urban planners and within a few years had been closed to use as those engaged in street drinking and antisocial behaviour drove away the families using the space. Often little commentary is given as to the long term funding for maintenance and policing for such areas and this creates real concern for sustainability (Eichler, 2019) and the potential is evidentially there that areas such as pocket parks can actually reverse urban improvement.

The litmus test for the physical regeneration model highlighted above would be whether it will actually work to reduce crime – or the perception of crime which is almost as important, whether it will genuinely increase footfall and vibrancy in Lower Eastgate, whether the proposed top-down development of a public “pocket park” will actually become a pleasant place for families to use or a haunt for street drinkers and whether the prioritisation of the pedestrian will benefit or be detrimental to local businesses which might rely on cars for their trade, and whether as a whole this intervention will encourage further inward investment. There is also the ever-present two-edged sword of gentrification with its potential concomitant challenges of exclusionary geographies and influx of spatial capital (Rérat & Lees, 2011). Concerns have been expressed in the local press about the effects of gentrification on rising house prices and rents and the displacement of lower-income families and smaller independent businesses (Gloucestershire Live, 2019). Without the genuine buy-in of the local community there is a potential that authentic locally based initiatives will be lost as regeneration is done “to” the community rather than “by” or with the community and its holistic stakeholder base – the antidote to this is for those involved in urban planning to look at community-centric models such as proposed feminist planners of Cole.Lectiu Punt 6 in Barcelona (Escalante & Ladivia, 2015) (Cole.Lectiu Punt 6, 2019) and repeat as a mantra the directions of Jan Gehl (1971) “Life, Spaces, Buildings – and in that order please”

References

Adams, F. et al., 1949. Panel I: The Neighborhood Concept in Theory and Application. Land Economics. Land Economics, 25(1), pp. 67-88.

ATCM, 2019. Purple Flag Status: How It Fits Place Management Policy. [Online]

Available at: https://www.atcm.org/purple-flag

[Accessed 26 November 2019].

Badger, E., 2012. The Evolution of Urban Planning in 10 Diagrams. CITYLAB.

Bailey, N., 2010. Understanding community empowerment in urban regeneration and planning in England: Putting policy and practice in context. Planning Practice and Research, 25(3), pp. 317-332.

Ball, M., 2004. Co-operation with the community in property-led regeneration. Journal of Property Research, 21(2), p. 119–142.

Baycan-Levent, T., 2010. Diversity and Creativity as Seedbeds for Urban and Regional Dynamics. European Planning Studies, 18(4), p. 565–594.

Brinkhoff, T., 2018. City Population. [Online]

Available at: https://www.citypopulation.de/en/uk/southwestengland/wards/gloucester/E05010953__barton_and_tredworth/

Carmo, A., 2012. Reclaim the Streets, the protestival and the creative transformation of the city. Finisterra, 47(94).

Cole.Lectiu Punt 6, 2019. Punt6.org. [Online]

Available at: http://www.punt6.org/en/who-are-we/

[Accessed Nov 2019].

Collins, T., 2016. Urban civic pride and the new localism. Transactions of the Institute of British Geographers, 41(2), pp. 175-186.

Dahir, J., 1947. The Neighbourhood Unit Plan. s.l.:Russell Sage Foundation.

Eichler, W., 2019. Council chiefs sceptical of £1.35m parks fund. [Online]

Available at: https://www.localgov.co.uk/Council-chiefs-sceptical-of-1.35m-parks-fund/48420

Escalante, S. O. & Ladivia, B. G., 2015. Planning from below: using feminist participatory methods to increase womens parcipation in urban plannig. Gender and Development, 23(1), pp. 113-126.

Florida, R., 2003. Cities and the Creative Class. City & Community, 2(1), pp. 3-19.

Furlan, R., Petruccioli, A. & Jamaleddin, M., 2019 . The authenticity of place-making. International Journal of Architectural Research, 13(1), pp. 151-168.

Gehl, J., 1971. Life Betwen Buildings. 2011 ed. s.l.:Island Press.

Gehl, J. & Svarre, B., 2013. How to Study Public life. s.l.:Island press.

Gloucestershire Live, 2018. https://www.gloucestershirelive.co.uk/. [Online]

Available at: https://www.gloucestershirelive.co.uk/news/map-reveals-true-scale-child-1124897

[Accessed 01 November 2019].

Gloucestershire Live, 2018. What ‘Purple Flag’ status could mean for Gloucester’s pubs and clubs. [Online]

Available at: https://www.gloucestershirelive.co.uk/news/gloucester-news/what-purple-flag-status-could-1080661

[Accessed 2 October 2019].

Gloucestershire Live, 2019. How gentrification has changed Gloucester, area by area. [Online]

Available at: https://www.gloucestershirelive.co.uk/news/gloucester-news/how-gentrification-changed-gloucester-area-3544576

[Accessed 17 November 2019].

Hamnett, C., 2003. Gentrification and the Middle-class Remaking of Inner London, 1961-2001. Urban Studies, 40(12), p. 2401–2426.

Isaacs, R., 1949. Panel I: The Neighborhood Concept in Theory and Application. Land Economics, 25(1).

Jacobs, J., 1961. The Death and Life of Great American Cities. 2011 ed. New York: Modern Library.

Kasarda, J. D. & Janowitz, M., 1974. Community attachment in mass society. American Sociological Review, 39(3), pp. 328-339.

Lawless, P. & Pearson, S., 2012. Outcomes from Community Engagement in Urban Regeneration: Evidence from England’s New Deal for Communities Programme. Planning Theory & Practice, 13(4), pp. 509-527.

Le Corbusier, 1929. The City of Tomorrow and its Planning. 2013 ed. London: Corier Corporation.

Le Corbusier, 1946. Towards a New Architecture. London: Architectural Press.

Lees, L., 2018. Comparative urbanism in gentrification studies: fashion or progress?. In: L. Lees & M. Phillips, eds. Handbook of Gentrification Studies. Cheltenham, UK:: Edward Elgar Publishing, pp. 49-60.

Lee, Y. & Kim, K., 2015. Attitudes of Citizens towards Urban Parks and Green Spaces for Urban Sustainability: The Case of Gyeongsan City, Republic of Korea. Sustainability, 7(7), pp. 8240-8254.

McArthur, J. & Robin, E., 2019. Victims of their own (definition of) success: Urban discourse and expert knowledge production in the Liveable City. Urban Studies, 56(9), pp. 1711-1728.

Moor, M., Rowland, J. & (Eds), 2006. Urban Design Futures. s.l.:Routledge.

Newton, P. & Glackin, S., 2013. Using Geo-Spatial Technologies as Stakeholder Engagement Tools in Urban Planning and Development. Built Environment, 39(4), pp. 473-501.

Police UK, 2019. Crime Map. [Online]

Available at: https://www.police.uk/gloucestershire/BA1/crime/

Pollard, J. S., 2004. From Industrial District to “Urban Village”? Manufacturing, Money and Consumption in Birmingham’s Jewellery Quarter. Urban Studies, 41(1), p. 173–193.

Rérat, P. & Lees, L., 2011. Spatial Capital, Gentrification and Mobility: Evidence from Swiss Core Cities. Transactions of the Institute of British Geographers, 36(1), pp. 126-142.

Sasaki, M., 2010. Urban regeneration through cultural creativity and social inclusion: Rethinking creative city theory through a Japanese case study. Cities, 27(1), pp. s3-s9.

Steinmetz-Wood, M. et al., 2017. Is gentrification all bad? Positive association between gentrification and individual’s perceived neighborhood collective efficacy in Montreal, Canada. International journal of health geographics, 16(1), p. 24.

Tizot, J., 2018. Ebenezer Howard’s Garden City Idea and the Ideology of Industrialism. Cahiers victoriens et édouardiens [En ligne], Volume 87.

Wilson, J. & Kelling, G., 1982. Broken Windows: The Police and Neighborhood Safety. Atlantic Monthly, Volume 211, pp. 29-32.

Wirth, L., 1938. Urbanism as a Way of Life. The American Journal of Sociology, 44(1), pp. 1-24.

Zimbardo, P. G., 1973. A Field Experiment in Autoshaping. London: Architectural Press..

Solutions to Urban problems are often proposed by urban planning professionals based on whatever urban planning theories hold sway at the time. Often these proposed solutions are generated “top down” by “experts” using an internationalist template of “best practice” with a cursory reference to the communities living within neighbourhoods. Is there a better, more effective way?

Solutions to Urban problems are often proposed by urban planning professionals based on whatever urban planning theories hold sway at the time. Often these proposed solutions are generated “top down” by “experts” using an internationalist template of “best practice” with a cursory reference to the communities living within neighbourhoods. Is there a better, more effective way?